An unprecedented year in review – and what lies ahead

2020 was a remarkably unusual year to say the least. Before we get into market updates, let’s quickly revisit where we stood roughly a year ago today and what happened in the aftermath of the COVID-19 pandemic.

Zooming out with a quick retrospective, in the five years leading up to the pandemic we favored high yield credit investments. Our overweighting towards credit was driven by our defensive posture. We recognized a notable deceleration in hotel operating fundamentals in late 2015 and early 2016, coinciding with market expectations of rising interest rates, the strengthening of the U.S. Dollar, and pronounced market volatility in part associated with China’s unexpected devaluation of the Yuan. Hotel valuations did not adjust to reflect the decelerating performance, rising interest rates, and higher risk. Instead, late cycle dynamics took hold and “tourist” / generalist investors rotated into the hotel sector in search of what they perceived to be higher relative returns.

So while we underwrote a lot of new acquisitions during the five-year period leading up to the pandemic, we couldn’t reconcile valuations with on-the-ground fundamentals and our approach was to pursue very little. Credit, meanwhile, seemed interesting, with sustained pockets of inefficiency and idiosyncratic situations that generalist lenders were poorly suited to pursue (e.g. a newly opened hotel with no operating track-record requiring hotel-specific expertise to underwrite). Credit also provides an inherent margin of safety, assuming you value properties correctly and get your “LTV” right. It’s also worth noting that our credit strategy purposely avoided using short-term repo and credit-line financing – a position informed by what we saw happen to lenders using those types of leverage tactics during the GFC.

Consequently, when the pandemic hit a year ago, we were very defensively positioned with a predominantly credit orientation. We sought hotels underlying our credit and equity investments that were invariably very high-quality high-end leisure-oriented hotels in major urban and resort markets. Such portfolio positioning allowed us to quickly focus on the investment opportunity created by the pandemic.

As a reminder, in March of last year we made two critical calls on the pandemic impact: 1) based on analyses of historical contagion events and demand shocks and some deductive reasoning we believed that hotel performance would trough 12 months after the onset of the pandemic (roughly March 2021) and performance would return to 2019 levels around the end of 2022; and 2) we laid out the phasing of investment opportunities ahead of us to serve as a guide for where we needed to focus our resources – first public market opportunities (e.g. CMBS, public stocks), then private credit / rescue capital, then asset sales.

Across our credit and equity strategies, we focused on a wide array of hotel investment opportunities in 2020, up and down the capital stack and across the security spectrum, including: preferred equity, CMBS bonds, public stock, distressed debt, senior mortgage loan origination, and asset acquisition. We combined our hotel expertise with our capital markets expertise to remain nimble but disciplined throughout our process. And we used the same hotel underwriting approach and operating expertise on each of these opportunities to take an informed perspective on the value of the underlying real estate and evaluate the risk-return opportunity presented by any given security / structure.

From a personal standpoint, the pandemic has presented terrible societal impacts and we are hopeful for a resolution to those impacts (to that end we’re very much looking forward to receiving vaccines and safely visiting with our families, friends, and business partners this year). From a professional standpoint, the pandemic has been the biggest test of our careers. Every hotel in the U.S. effectively shut down last year. It was truly unprecedented. But there were silver linings for us. We had the opportunity to test the value of the theoretical underpinnings to our investment approach. We have the opportunity to show why being a specialist in our space is so critical, not only to appropriately price risk and build margins of safety pre-shock, but also to quickly source and identify new investment opportunities post-shock. And we have the opportunity to demonstrate the strength of our internal processes and the resiliency and adaptability of our organization.

It took every member of our team to deliver on the approach described above and below, and a letter like this one hardly does justice to the hard work and unwavering commitment from our various team members. While we would never raise our hand to go through another pandemic, we’re grateful for the professional opportunities it provided us and we’re immensely proud of our accomplishments so far.

We still have work to do. The pandemic is not over. Nor is the attractive investment opportunity. To that end, let’s take a quick look at market dynamics.

Market Update – The Return of Optimism and the Beginning of Phase 3

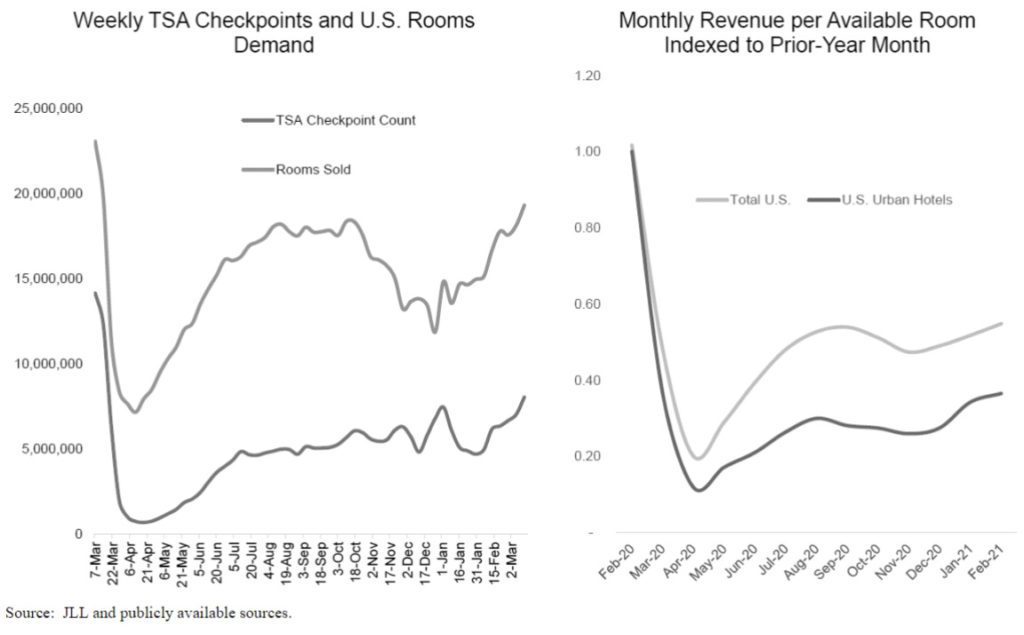

While hotel operating performance is still materially below “normal” levels, a rebound in performance appears to be taking place. In particular, and unsurprisingly, leisure travel has started to rebound more quickly than corporate. As the charts below show, Rooms Sold and monthly RevPAR recently reached Post-COVID highs. Additionally, non-urban hotels are outperforming urban destinations, which are more reliant on corporate and international travel. We subscribe to the view that there will be significant pent-up demand that will drive a strong rebound in hotel operating performance, and that’s consistent with our prior calls around the shape of the recovery. However, we continue to remain appropriately cautious in how we underwrite a potential rebound in light of lingering questions around vaccine roll-outs, virus variants, international travel, and a recovery in group and business travel.

As a result of the growing optimism around a performance recovery, we are starting to see capital come off of the sidelines to pursue credit and equity investments in hotels. Each week the demand for new deals becomes incrementally more broad-based. On the lending side, a handful of private debt funds have been the most active lenders in the hotel space, but balance sheet lenders (i.e. banks) and even the CMBS channel are also now coming back into the market. As a result, we believe credit spreads have tightened ~200bps from last summer and ~100bps in the past ~6 months. Additionally, other debt terms such as call protection and reserves are being chipped away, helping to restore a more normal liquidity to the hotel lending markets.

On the asset acquisition side, we are seeing early signs of growing interest from all types of buyers. Bid-ask gaps have narrowed from their widest points a year ago (helped in part by improving debt market liquidity), and sellers are now relatively more willing to transact – these dynamics indicate that the third and final phase of the investment opportunity set we mapped out (i.e. asset acquisitions and JV recapitalizations) is now in full effect.

Notably, publicly traded hotel REITs are some of the most aggressive pursuers of acquisitions. These groups are starting to be very aggressive in trying to find acquisition opportunities with a focus on leisure, driven by seeing green shoots of a recovery across their own portfolios. And what started in February with a couple of REITs racing to beat other REITs to the acquisition story line has now become a race among almost all REITs trying to find acquisitions.

The other theme we’re seeing in the acquisition and lending markets is “frustrated capital” – frustrated capital is the moniker being given by our broker community to prospective buyers who have spent the past 12 months desperately trying to make investments in hotels only to come up empty-handed. In our opinion, the challenges that a lot of these groups have had are: 1) they are generalists who tried to enter into a complicated and quickly evolving sector and didn’t have the necessary network, database, or internal tools to unlock opportunities, and 2) they didn’t spend time upfront solidifying their view of a recovery pattern in a way that would allow them to appropriately value opportunities and move with conviction (again, mostly a data and experience issue). Said another way, they chased the handful of marketed opportunities and generally defaulted to bidding very large discounts. These groups consistently felt a few steps behind us when we would see them / hear about them in the market. They are now either leaning in to “get something hotel-related on the board” and show that they got exposure to the hotel theme or, in some cases, they’re waving the white flag.

The hot take on these dynamics in the transaction market is that we expect a pronounced uptick in transaction activity in the third and fourth quarters of this year at valuation metrics that in some cases will surprise to the upside. We are currently monitoring a handful of situations in our space where leisure-oriented assets are being quietly marketed and could trade in the 4.5%-6.0% cap rate range on 2019 NOI and well north of $1mm per key.

Zooming out, none of these dynamics are all that surprising to us. And not to sound like a broken record, but as we described in the beginning of this letter (and have described in other letters) we made our COVID calls on a recovery pattern early, we leveraged real-time data to test and recalibrate these calls, and we utilized our network and database of information to move on opportunities with speed and conviction.

Please refer to disclaimers for important considerations.