Hotel demand, capital markets, investment themes and more

In our 2nd quarter update, we discussed the three main demand segments for hotels (leisure transient, group, and business travel) and the green shoots we were seeing in the group segment. We also noted that we expected to see the front edge of a business travel recovery with post-Labor Day return to office plans, but caveated that we were paying close attention to the Delta variant.

As we progressed into the 3rd quarter, the Delta variant became more prevalent. Many companies pushed out their return to office plans to later in 2021 or early 2022. Consequently, group demand saw some choppiness in the 3rd quarter with some cancellations, and business travel did not see the post-Labor Day ramp up that many industry participants had hoped for. But the net effect of the data we saw in the 3rd quarter and heading into the 4th quarter suggests that group still seems to be charting its path to a recovery, and even business travel is starting to show early signs of progress. Moreover, our segment of the market (more leisure-oriented hotels) continues to see stronger-than-normal post-Labor Day leisure demand – a continuation of a Post-COVID theme where historical travel seasonality patterns have been upended (likely temporarily). As a result, the group cancellations that we are seeing are generally able to be back-filled with attractive leisure transient demand.

For the 4th quarter of 2021 and heading into 2022, our view on group and business travel remains appropriately conservative but markedly more positive compared to same time last year. Examining a sample of leisure-oriented hotels shows a narrowing in the gap between 2021 forecasted group room nights and room nights that are currently on the books, meaning most of the forecasted demand through the end of the year has already been secured. In addition, group sales bookings are now largely focused on 2022 bookings.

In terms of the shape of the recovery for the three primary hotel demand segments (leisure transient, group, and business travel) our current views are as follows:

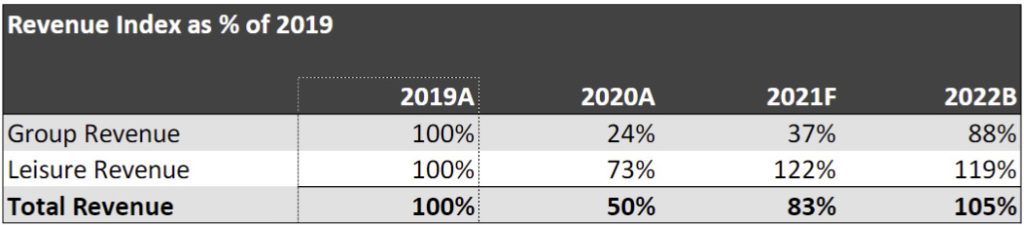

- Leisure Transient: Leisure transient has clearly been the first segment to recover. Demand, measured in aggregate $ revenue, has surpassed 2019 levels at most leisure-centric hotels. Looking out into the future, we expect a normalization of leisure transient demand in 2023/2024, with a pull-back in performance from current levels but with leisure demand ultimately settling at a stepped-up trend line vs. the Pre-COVID trendline.

- Group: Based on the dynamics for group demand referenced above, we still expect group to continue to ramp up through 2022 and ultimately recover to 2019 levels in 2023/2024. As group demand recovers during the next 24-36 months, it will help to offset the expected pullback in leisure transient demand. The net effect of this rotation will likely be higher revenue and profit for upscale leisure-oriented hotels and resorts.

- Business Travel: Business travel will be the last segment to recover, however at this time we don’t expect business travel to recover to its Pre-COVID trendline. We anticipate changes in business travel preferences and patterns, and we expect business travel demand at the national level to ultimately settle lower than Pre-COVID levels with softer demand on Mondays and Thursdays (the book ends of the business travel demand window). However, we believe certain leisure-oriented hotels in heavier business travel markets could backfill lost business travel demand with attractive leisure demand or possibly “bleisure” demand where business travelers extend their stay into a leisure trip / end of week / weekend stayover.

After examining a sample of leisure-oriented hotels. below is a sample snapshot of how we see revenue tracking in 2021 and 2022 with revenue data indexed to 2019 levels. It’s worth noting that there’s noise in our data because of active asset management and turnaround plans at each sample property, so the data isn’t entirely “same-store”. Also, the business travel segment was excluded because it represents only ~3.5% of the sub-portfolio’s direct revenue base.

While business travel has less of a direct impact on our existing portfolio, we are closely monitoring business travel trends, particularly in major gateway cities where we are actively pursuing opportunities (more on that below). AHLA (a hotel industry group) and Kalibri Labs (an independent data analytics firm) project that U.S. business travel revenue will finish 2021 at 23% of 2019 revenue. Among the largest cities, New York City is projected to finish at 12% of 2019, San Francisco is projected to finish at 7% of 2019, and Los Angeles is projected to finish at 28% of 2019. Almost all of the projected business demand for 2021 is coming in the 2nd half of 2021.

As another reference point, here’s a research note from TripBAM, a hotel re-booking company that focuses exclusively on business travel and processed more than 20 million bookings in 2019 ($10bn+ in hotel spend):

TripBAM’s hotel booking volumes weakened in the second half of August, but have since been improving. The company expects this trend to continue through October, with November and December likely to exhibit seasonal weakness. TripBAM forecasts global booking volumes reaching 40-50% of 2019 levels by year-end 2021 and 80% by year-end 2022. Due to enhanced technology, sustainability initiatives, and budget cuts, the company expects 20% of business transient demand to be eliminated long-term as a result of COVID changes in behavior… Looking out to year-end 2021, the company expects [nightly] rates to continue to increase and even surpass 2019 levels. This trend has already happened in more leisure-oriented US markets like Las Vegas and Orlando, and TripBAM expects to see it in more business-reliant hubs, like New York and Chicago.[1]

While there’s some disparity in the projected recovery timeline between Kalibri and TripBAM, likely due to nuances in what each company is measuring, it’s clear that we are starting to see the beginning of a recovery in business travel, which should start to support a recovery in major urban markets in the coming months.

Capital Markets Update

3rd Quarter Hotel Sales Activity

The 3rd quarter saw a handful of notable transactions. Interestingly, whereas the first half of the year generally skewed towards resort asset sales, the 3rd quarter saw an uptick in activity within urban markets. Private equity buyers and REITs remain the most active buyer types. However, REITs have taken a bit of a breather on the acquisition front as their stock prices declined due to Delta variant concerns. International buyers are less active right now.

Debt Capital Markets

Debt capital markets continued to improve throughout the 3rd quarter as more capital started to flow into hotel debt markets in search of yield and pursued a scarce number of opportunities. Lenders have overwhelmingly favored leisure-oriented hotel properties and acquisition loans where a new sponsor is investing fresh equity.

Current Investment Themes

So what do the aforementioned demand trends mean with respect to the investment themes we like right now?

Major Urban Markets:

Major urban markets are typically more reliant on business travel and city-wide conventions to support demand. As a result, we have been fairly cautious on urban opportunities since the onset of the pandemic because we anticipated a longer recovery time for these markets. However, as we see an uptick in business travel demand and group demand for cities, we see opportunities in major urban markets. We also see an opening of U.S. borders to international travelers as another tailwind that could support performance of hotels in major urban markets. In particular, we are evaluating opportunities in New York, Boston, Washington D.C., Los Angeles, San Francisco, and certain Sunbelt cities.

Notably, we are seeing more stressed / distressed situations as owners and lenders capitulate and recognize they “finally need to do something” about stressed properties / capital stacks. We believe we will continue to see an uptick in opportunities as we approach the winter months, which are typically the low season in most cities and a time when hotels typically run at slimmer profit margins or even monthly operating losses (meaning the hotel runs at breakeven and all debt service needs to be funded with equity infusions from an owner).

Given the aforementioned dynamics around business travel demand patterns and occupancy trends, we favor high-quality physical hotel properties in leisure-oriented locations and with leisure-oriented finishes and amenities. The leisure orientation will protect Thursday – Monday demand patterns as those likely evolve Post-COVID. We also generally favor unbranded or soft-branded hotels. Traditional branded corporate hotels in city center locations typically rely on an occupancy-driven strategy due to reimbursement schemes with the large hotel brands[2] and are typically fairly commoditized product that function as price takers (their main competitive advantage is pricing at a discount to peers). As a result, we believe there’s a risk that these hotels will fight for a reduced base of mid-week business demand by aggressively dropping rate, and that approach will likely lead to lower revenue and profit in that segment of the market. We believe the performance at these properties, especially commoditized boxes in financial and business districts, will further suffer from an inability to attract needed leisure demand due to their locations and positioning. These dynamics will play out differently in different cities depending on other factors like supply dynamics (e.g. see our letter from Summer 2020 discussing our views on NYC).

Broken Ownership / Lending Partnerships:

We have seen an uptick in recent months in opportunities where ownership or lending partners are fighting. Reduced cash flows and stressed capital structures have created a significant amount of tension between partners, as properties need an injection of capital to undertake capex projects, cover operating shortfalls, or to refinance maturing debt. In many instances there are partners who are unwilling or unable to fund capital calls. In credit stacks, we are seeing lending partners fight over whether to make protective advances / cash infusions or whether to foreclose. A lot of these lenders don’t have the ability to take over a hotel due to a lack of hotel operating capabilities or tax consequences. Moreover, because of the potential reputational and headline risk of broadcasting these disputes to the broader market, most of these parties prefer to resolve their issues quietly through off-market processes.

Group Hotels with Repositioning Opportunity:

We continue to like the trajectory of group demand going forward, and we benefit from being able to leverage our real-time data on group booking patterns across various markets. We are actively pursuing opportunities where a group hotel can be upgraded, upflagged, or otherwise repositioned to repurpose space “within the four walls of the box” to drive revenue and profit.

Complex Resort and Leisure Properties:

We continue to pursue resort and leisure properties given our long-term thesis around resort supply and because we can typically count on something being broken given the complexity of operations (e.g., capital structure, ownership structure, operations, level of capital investment, branding / positioning). These properties are definitely more expensive today than they were at the start of the year. And in many instances, we’re seeing asking prices that represent premiums to 2019 valuations.

Newly Built Hotels (Primarily Credit):

One of our favorite Pre-COVID credit strategies is showing signs of life. There are a number of hotels that were commencing or under construction at the outset of COVID that are opening in the coming months. Generalist lenders are having a difficult time underwriting the ramp-up in performance given the lack of historical operating data. Combined with a return of balance sheet lenders to the hotel space who typically focus on senior loans, we expect an uptick in mezzanine opportunities in the coming months.

Please refer to disclaimers for important considerations.

[1] Morgan Stanley equity research, October 12, 2021.

[2] The basic structure of these reimbursement schemes is as follows: when a guest books a hotel room with “points”, the hotel owner and the brand have a formula that determines how much the brand has to reimburse the hotel owner for that booked room (because a hotel owner can’t pay the bills with points). These formulas dictate that the brands pay the hotel owner more if the occupancy of the hotel on a given night is higher (say 95%) than if it is lower (say 50%). This simple approach is based on the theory that the opportunity cost of allowing that points redemption “costs” the owner more on the 95% occupied night because the owner could have leased the room at a high nightly rate given strong demand. Over the past decade, these formulas have caused hotel operators in markets like NYC to take a very aggressive occupancy-driven strategy, even if it means dumping rooms at low nightly rates in order to achieve 95%+ occupancy in order to trigger the highest reimbursement level possible.