Updates within the hotel sector and bullish moves on a key investment theme

Market Update – Phase 2 In Full Swing

In our first quarter investor letter addressing the anticipated dislocation caused by COVID-19 we laid out how we expected investment opportunities within our space to unfold:

- Phase 1: publicly traded debt and equity securities (CMBS SASB bonds, unsecured corporate bonds, publicly traded common stock, and publicly traded preferred equity)

- Phase 2: private credit and “gap” capital (loan originations, loan sales, preferred equity rescue capital, and other structured solutions)

- Phase 3: asset sales (and joint venture recapitalizations)

Much of the Phase 1 opportunity (especially public credit) dissipated by mid-summer due to aggressive actions by the Federal Reserve. At the same time, there were very few Phase 2 opportunities in June and July because many borrowers in our space were enjoying short-term lender forbearance periods that provided relief from having to pay debt service. The average term of these forbearance periods was typically 3-6 months. Additionally, most hotel owners were further shoring up liquidity by borrowing money under the U.S. Government’s Paycheck Protection Program (“PPP”), which could cover 2-3 months of payroll and other operating expenses. Combined, these liquidity relief mechanisms provided a summer vacation (relatively speaking) for owners of high-end hotels and for lenders who wanted to kick the can and hope for a quick rebound. That vacation ended in August.

In August, lender forbearance periods began to expire, and borrowers had to begin paying debt service once again. The end of lender forbearance periods coincided with hotel owners exhausting PPP funds. And hotel performance had not bounced back. The curtailment of these relief mechanisms put significant pressure on hotel owners and lenders. The result was a flurry of loan sales, loan refinancings, and preferred equity raises. Phase 2 was in full swing. By September our investment pipeline had swelled to the largest we have seen it in the past six years. And we also started to see signs of Phase 3 (asset sales) forming.

An Introduction to Phase 2 – Private Credit

The processes for our two recent investments provide interesting windows into current dynamics in hotel private credit markets. Debt capital for hotels is notably scarce as the majority of lenders are sitting on the sidelines (and in most cases navigating legacy issues). The lenders that are participating in the market seem to be overweighting towards (1) large “marquee” deals where they can invest a sizable amount of money in a single financing and (2) acquisition financing opportunities where fresh equity is being invested by a new buyer. These dynamics are causing huge disparities in debt terms across deals, and these disparities are driven more by credit underwriting / capital deployment decisions (and credit committee talking points) than asset-level underwriting.

We seek to capitalize on our constant involvement in the credit markets to identify and exploit capital pricing inefficiencies as both a lender and a borrower. We are starting to see some senior debt liquidity flow back into the hotel credit space, which is creating an attractive opportunity to target what has historically been our core credit strategy of mezzanine loans. We expect to be more active in pursuing those opportunities in the coming months alongside certain senior lender relationships we have.

A Preview of the Next Letter – Looking at Phase 2 Preferred Equity and Phase 3 Asset Sales

In our next letter we will take a look at aspects of other Phase 2 opportunities (namely preferred equity and structured loan acquisitions) and the early stages of what we’re seeing in Phase 3. We are finding in both instances that we greatly benefit from having invested and managed through the 2009-2013 market dislocation, and we greatly benefit from all of the tools in our expansive toolkit.

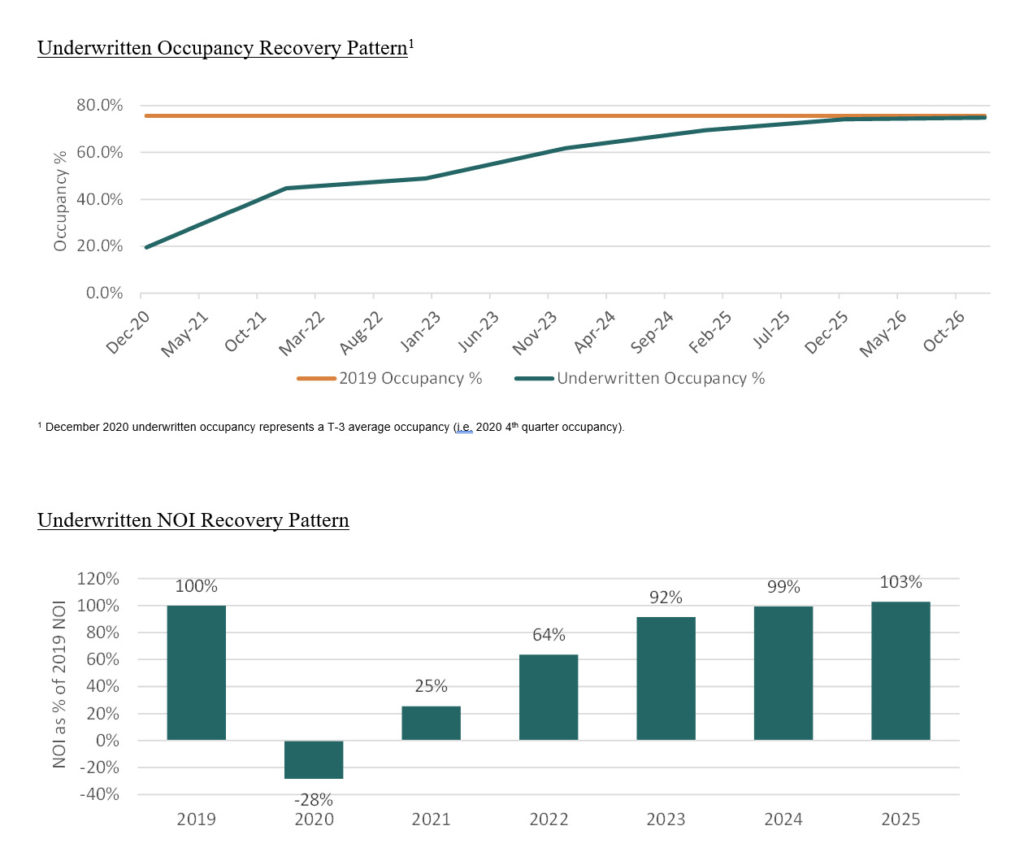

A Quick Aside – How We Are Underwriting?

We thought it might be interesting to finish this update with a quick look at how we are generally underwriting projected hotel performance given the pronounced uncertainty. In a word: conservatively. You will recall from our second COVID update letter from March 17th that we made a very early projection that average hotel performance across the U.S. would take ~3 years to return to 2019 levels (based on an analysis of prior contagion events and demand shocks). We made sure to caveat our March projection by acknowledging it was WAY too early to really know, but after ~8 months we think that projection is still a pretty good one (but will vary across specific assets and markets). However, in the various deals we’re pursuing we’re actually underwriting a much more conservative recovery pattern, and often times 5-6 years to recover to 2019 performance (i.e. performance recovers in 2024/2025). Of course, a near-term delivery of a vaccine could certainly accelerate our outlook on a recovery, and we will be closely monitoring booking patterns at our hotels during the next few months as we expect to hear more about vaccines to determine whether a recalibration in our projections is warranted. The charts below show underwritten recovery patterns from a sample of our recent deals.

Please refer to disclaimers for important considerations.